While most used car dealers operate their businesses with integrity, unfortunately, some are not transparent about the fine print in financing contracts and the condition of the vehicles they sell. If you’ve experienced auto fraud, there’s good news: California has laws in place to protect you.

But what differentiates unethical business practice from fraud, and what are your rights in California? We’ll explain below.

What is Auto Fraud?

According to California state law, auto fraud entails several deceptive practices, including the following:

1. Misrepresentation of Vehicle History: This occurs when the seller intentionally hides or misrepresents critical information about a vehicle, including prior accidents, mileage, title status, whether it has a previous history as a rental vehicle, and more.

2. Used Vehicle Buyer’s Guide: The buyer’s guide should be affixed to the vehicle when you purchased it. California law entitles you to a copy of this guide.

3. Yo-Yo Financing & Payment Packing: Buyers should be given clear financing conditions.

One common fraudulent practice occurs when sellers let the buyer take the vehicle before finalizing financing and then pressure them into signing a new contract with less favorable terms. Another, called payment packing, occurs when dealers quote a higher monthly payment and add in “free” extras they charge for.

4. Odometer Tampering: This occurs when the vehicle's mileage is tampered with to make it look less used.

5. Title Washing: This is a process of moving a salvaged vehicle through different states to receive a clean title to conceal its previous damage history.

What Are My Rights in California?

California law has several laws and regulations in place to protect consumers. These include:

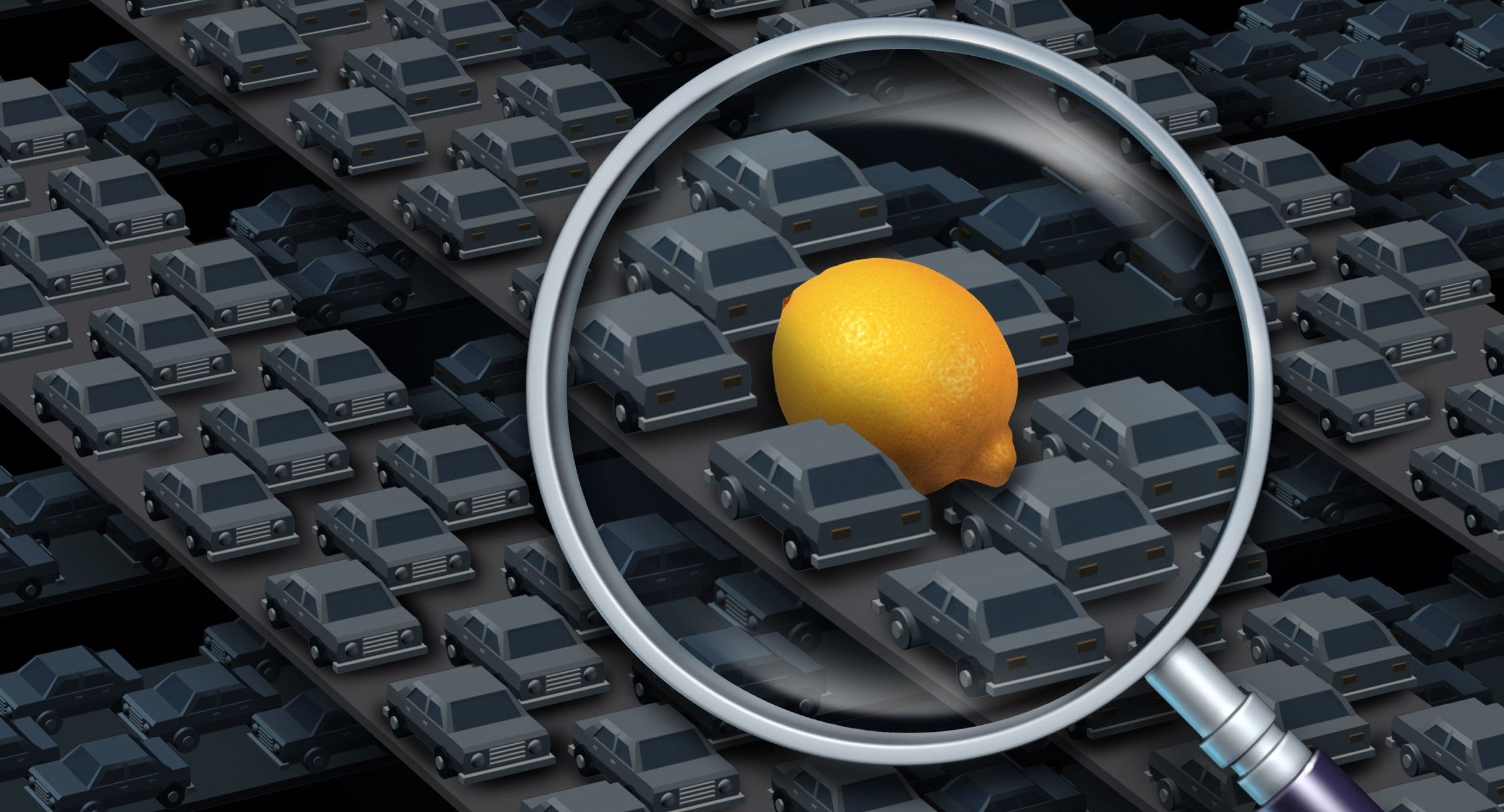

1. The California Lemon Law: This law offers recourse to consumers who have purchased a “lemon”—a vehicle that is plagued by recurring mechanical issues, safety hazards, and other defects.

2. The Consumer Legal Remedies Act (CLRA): Under the CLRA, consumers have the right to take legal action against unfair and deceptive practices.

3. The Federal Trade Commission’s Used Car Rule: This rule requires deals to display a buyer’s guide on the vehicle at all times.

4. The Truth in Lending Act (TILA): TILA requires creditors to disclose key credit terms, including the annual percentage rate and the total finance charge.

5. Vehicle Code & Civil Code: These codes protect consumers from odometer tampering, title washing, and more.

6. Right to Cancel: In some cases, like when sellers engage in yo-yo financing, consumers may have the right to cancel a vehicle purchase within a set period of time.

Let Us Take the Wheel & Protect Your Rights!

Are you a California consumer who purchased a defective car, RV, motorcycle, or product that fails to meet warranty standards? Don’t let auto fraud sour your buying experience. Get legal assistance from CA Consumer Law APC. Request a free consultation today!